SWOT analysis of financial services industry |Example

Hello readers! Here we are going to discuss on SWOT analysis of financial services industry with examples. You can also download the template/ format of both the Risk identification template and the SWOT analysis format given below link.

Download the SWOT analysis template/format.

Download the Risk analysis Format/template.

As all of you know Risk assessment is an important thing for the financial services industry. You can identify the risk and opportunities of the financial services industry by using several tools but here we will discuss only the two common tools i.e. [1] SWOT Analysis tool and [2] Risk and Opportunity Format. Both tools will be helpful to control and mitigate the Risk.

SWOT Analysis:

The full form of the “SWOT” is S-Strengths, W-Weaknesses, O-Opportunities, and T-threats.

How to do a SWOT analysis?

- Form a CFT team.

- List out all types of Risks related to individual functions and activities.

- Seat together for the final list and do the SWOT analysis.

The financial sector consists of organizations such as banks, Insurance companies, Mutual Fund Companies, Investment agencies, non-banking sectors, etc.

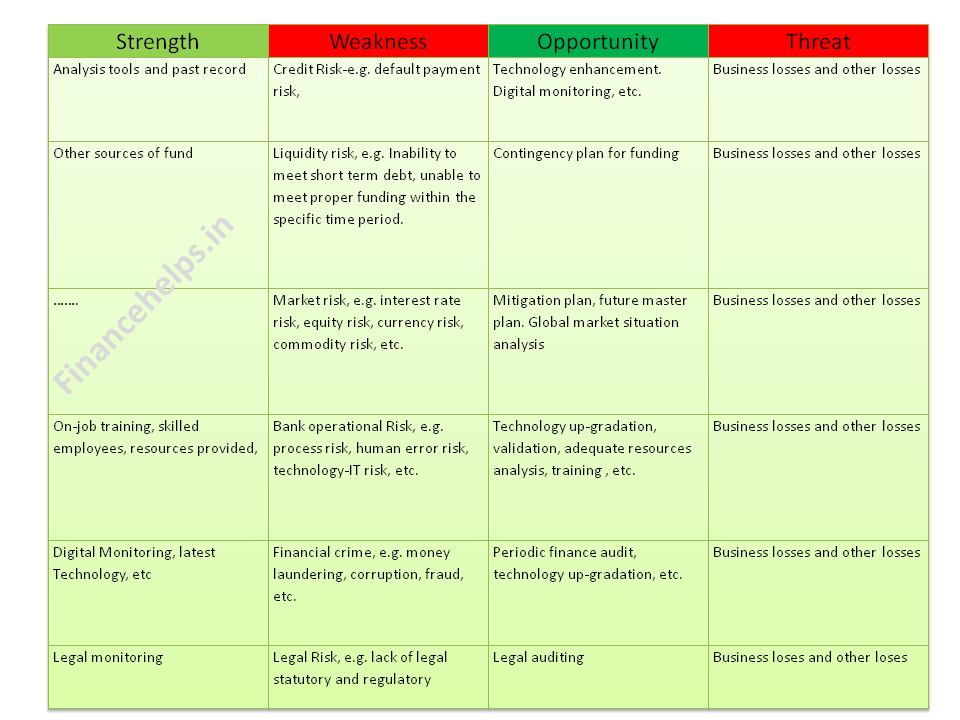

Here I have taken the banking sector for SWOT analysis, given risks are on a sample basis and not limited to. And may vary from bank to bank.

Example:

| Strength | Weakness | Opportunity | Threat |

| Analysis tools and past record | Credit Risk-e.g. default payment risk, | Technology enhancement. Digital monitoring, etc. | Business losses and other losses |

| Other sources of fund | Liquidity risk, e.g. Inability to meet the short-term debt, unable to meet proper funding within the specific time period. | Contingency plan for funding | Business losses and other losses |

| ……. | Market risk, e.g. interest rate risk, equity risk, currency risk, commodity risk, etc. | Mitigation plan, future master plan. Global market situation analysis | Business losses and other losses |

| On-job training, skilled employees, resources provided, | Bank operational Risk, e.g. process risk, human error risk, technology-IT risk, etc. | Technology up-gradation, validation, adequate resources analysis, training, etc. | Business losses and other losses |

| Digital Monitoring, latest Technology, etc | Financial crime, e.g. money laundering, corruption, fraud, etc. | Periodic finance audit, technology up-gradation, etc. | Business losses and other losses |

| Legal monitoring | Legal Risk, e.g. lack of legal statutory and regulatory | Legal auditing | Business losses and other losses |

Similarly, we have taken one of the above risks for risk analysis and ranking as a bank Operational Risk.

| Risk | Probability | Impact | Risk value | Risk rank |

| Delay on payment | 1 | 1 | 1 | 3 |

| Wrong transaction | 1 | 5 | 5 | 1 |

| Human error in payment or other activities | 1 | 5 | 5 | 1 |

| Loss of cash/threat during transit from bank to customer due to threat/ robbery by the third person | 1 | 5 | 5 | 1 |

| IT/ System Error | 1 | 4 | 4 | 2 |

We have discussed both two methods by using different tools one is SWOT analysis and another is Risk analysis. You can also use other different tools for the analysis of risk. But the important point is to identify the risk, risk rank, control mechanism, and mitigation plan.

Keep visiting Financehelps.in

Hi, I’m SG. Pradhan, the author & owner of the website “financehelps.in”. My expertise is in Financial Management & Accounting, Quality Management, Operation Management, Business Excellence, and Process Excellence. I am mech. engg. & certified internal and lead auditor.