0 INR

0 INR

Personal Loan EMI Calculator

Hello readers! Today we are going to cover the important topic on personal finance on loan calculation and monitoring. You can easily calculate the loan amount by the help of manual calculation or you can use any software for it like excel sheet. In online many calculators are available for loan EMI calculation. If you would like to calculate the loan EMI then go through the below link to calculate the particular type of loan as per your loan category as given below.

Two Wheeler Loan EMI Calculator

Bike Loan EMI Calculator

Personal Loan EMI Calculator

Car Loan EMI Calculator

Home Loan EMI Calculator

Loan Calculator

EMI Calculator

Why Loan Calculation is Important:

You are supposed to know below important points before applying for the loan. Below are the important points that you have to keep in your mind.

- Financial Planning

- Budgeting

- Comparison of loan options

- Finance Risk assessment and management

- Loan term, condition, compliance obligation.

- Payment Tracking

- Adjustment

- Rate of interest

- Early detection of issues, etc.

Financial Planning and Budgeting:

Definitely, as a borrower we have to plan our finances and budget that how much we will need to pay each month EMI, to do so, first of all, we have to use the EMI calculator to get an idea of per month loan amount, accordingly you can easily plan your financial budget.

I personally follow my own rules that my monthly EMI loan amount should not exceed 50% of my monthly income. Similarly, for better financial budgeting and loan principal amount decisions you can make your own rules as per your monthly income.

Comparison of loan options:

It’s an important point that debtors can compare loan options by calculating and comparing the monthly EMI amount, total loan payable, interest rate, loan tenure, and total interest amount payable.

Risk Management:

You should evaluate the ability to make monthly EMI and overall financial health by risk management.

Payment Tracking:

Regular tracking of your monthly EMI will help you for smooth loan payments and help you identify potential issues or risks early on.

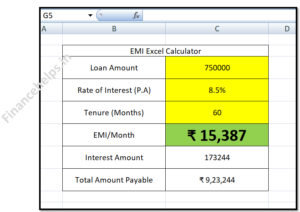

How to calculate Automatic EMI in Excel Sheet:

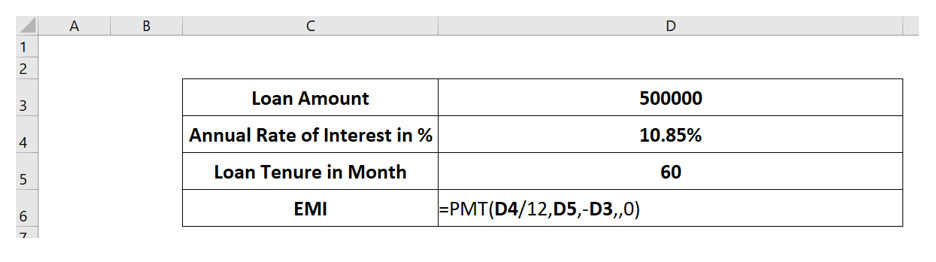

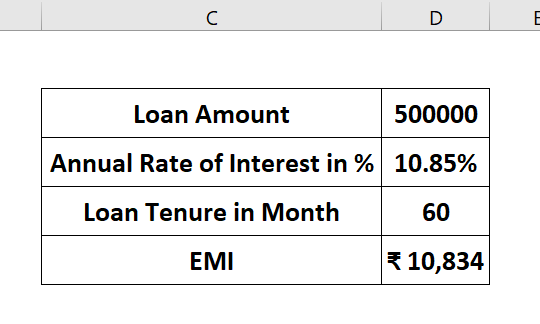

Suppose are going to calculate the EMI amount for the principal loan amount of Rs. 500000/- for a tenure of 60 months (5 years). Follow the given below step-by-step guide to do the EMI calculation in excel sheet.

- Open the Excel sheet

- Write the Below Points

- Select any cell of excel sheet and use the below function

=PMT (rate, nper, pv, [fv], [type])

Please note, the rate of interest will be monthly, you have to put “-“ sign before pv value, and finally you have to select “0” end of the period.

Example:

EMI:

Keep Visiting: financehelps.in

Hi, I’m SG. Pradhan, the Author & Owner of the website “financehelps.in”. My expertise is in Financial Management & Accounting, Quality Management, Operation Management, Business Excellence, and Process Excellence. I am Mech. Engg. & MBA graduate, certified internal, lead auditor & BB in SS